Over the years, I’ve become much more aware of the intrinsic hope that bad news will help the market. Investors are sure the FED will be there at their darkest hour, so the forward guidance and interest rate rising suggestion are not really changing their minds. ‘The Market believes the Fed will bail them out.’

Aside from listening to talking heads such as Janet Yellen and Ben Bernanke be wrong time after time after time, the market learned in 2008 that if the problem gets big enough, the treasury will turn on the money printing machines. The FED has yet to convince them otherwise. So when value disappears from the market, investors resort to the ‘Greater Fool Theory’ — to buy something today ‘hoping’ to sell it for more tomorrow. ‘Buying the dip’ has become the rally cry of this sector, and this sector is huge. a 10% drop makes everything feel cheap and creates false bottoms in market corrections.

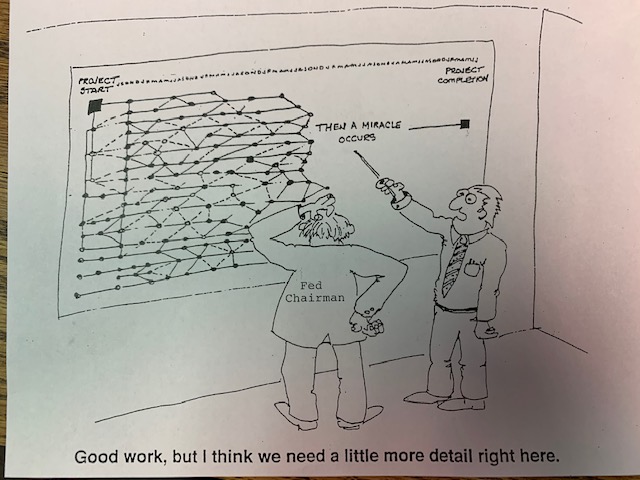

As we have written about many times, the amount of money the FED has printed HAS to create inflation; there is no avoiding this. The FED used every arrow the their quiver to keep control of it, but throw in a black-swan like COVID and all the planning in the world couldn’t stop this.

If interest rates continue to raise as the FED indicates they will, the market will react negatively. Without any true value in the market, the conservative investors will take the inflated gains and look for safer options. They just have to begin to believe there is no bailout coming. The FED has to continue to raise rates. This is when many investors should consider ‘getting up from the table’ and cashing in. When will all this happen? Clearly I don’t know. But all signs are flashing red that there is a problem.

If you are holding general market investments and want to talk about your positions, please feel free to give me a call. Risk analysis in a portfolio will make a huge difference once this market pops.

Sincerely,

Phillip Haydn Connors

Investment Adviser

Value Financial Advisers, Inc

3600 S. Beeler St

Suite # 300

Denver, CO 80237

Office: (303) 770-3030

Fax: (303) 773-9122